In a previous post, I calculated the total cost of leasing a Tesla, using my own experience as an example. Before we move on to the buying option, let me mention one important feature of leasing: It has more certainty in terms of total cost. You know what you pay, and you do not worry about unexpected major repair costs (as they are covered). At the end of the lease, you return the car. That’s it.

Now let’s turn to the other side of the comparison: What if I buy a Tesla and take out a loan?

Let’s quickly go through how we are going to compare:

- We are going to assume that we are going to buy a car with the same sticker price as the previous leasing example;

- You are going to take a loan with interest, or with cash (where the interest rate is 0%); For simplicity we assume it is a 3-year loan.

- The car depreciates with a certain rate;

- At the end of year 3, you sell the car.

- The total loan cost = What you have paid – what you get by selling.

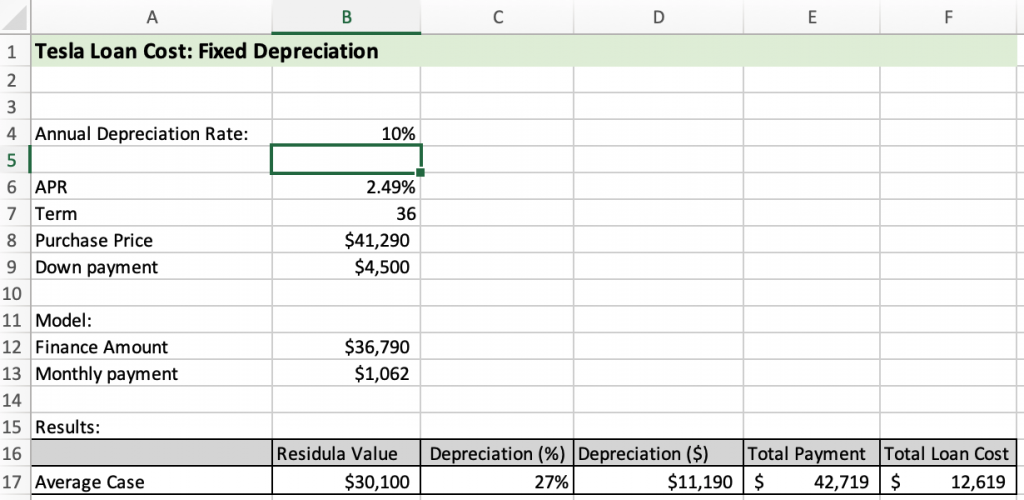

The spreadsheet model is easy to set up:

Note that I input the same price of the car and the same down payment. At annual depreciation rate of 10%, the 3-year total depreciation rate is 27%, exactly the same as the one assume in the previous leasing case.

From that calculation, we see that the total cost of buying a Tesla (a Model Y, in this case) is $12,619. That is lower than the $18,769, for leasing.

End of story, right?

Well, not yet. The key question I want to ask is: How sure are you that you are going to get the $30,1000 residual back when you sell the car in 3 years?

The depreciation rate of 10% per year is just an estimate (i.e., best guess). You most likely will get a different number, which could be higher or lower than 10%. There are a lot of factors that affect what you are going to get:

- Supply: There may be a lot more used Tesla cars on the market in 3 years. Or less.

- Demand: More people may want a used Tesla cars. Or less.

- Other random factors: You car’s appearance, condition, your location, your mood, …

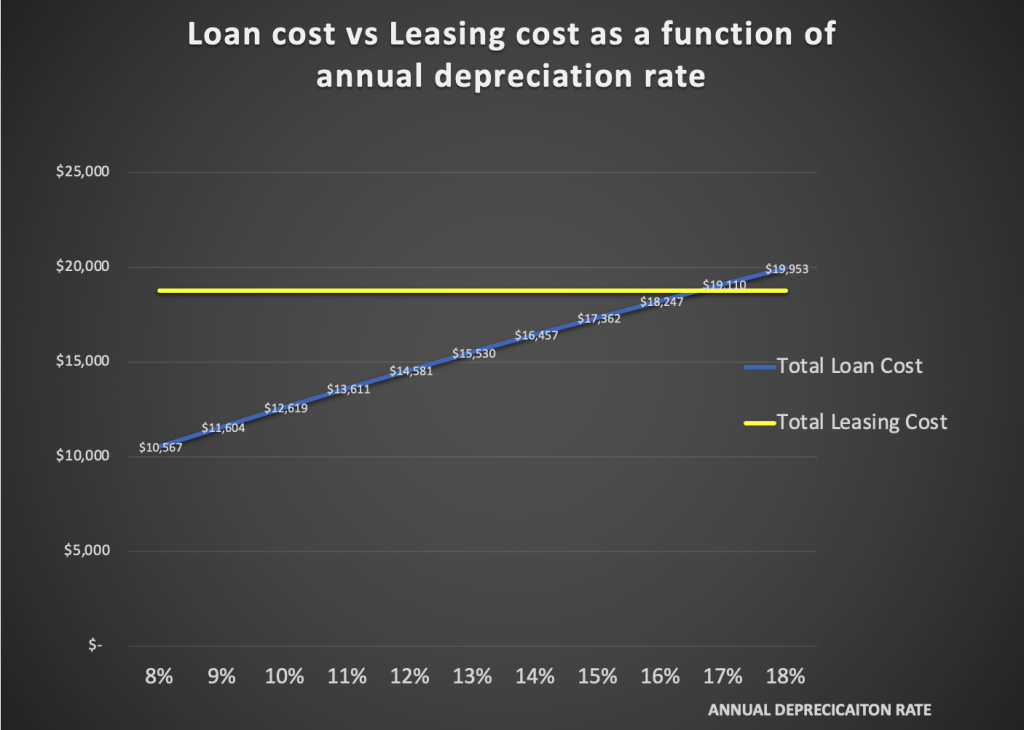

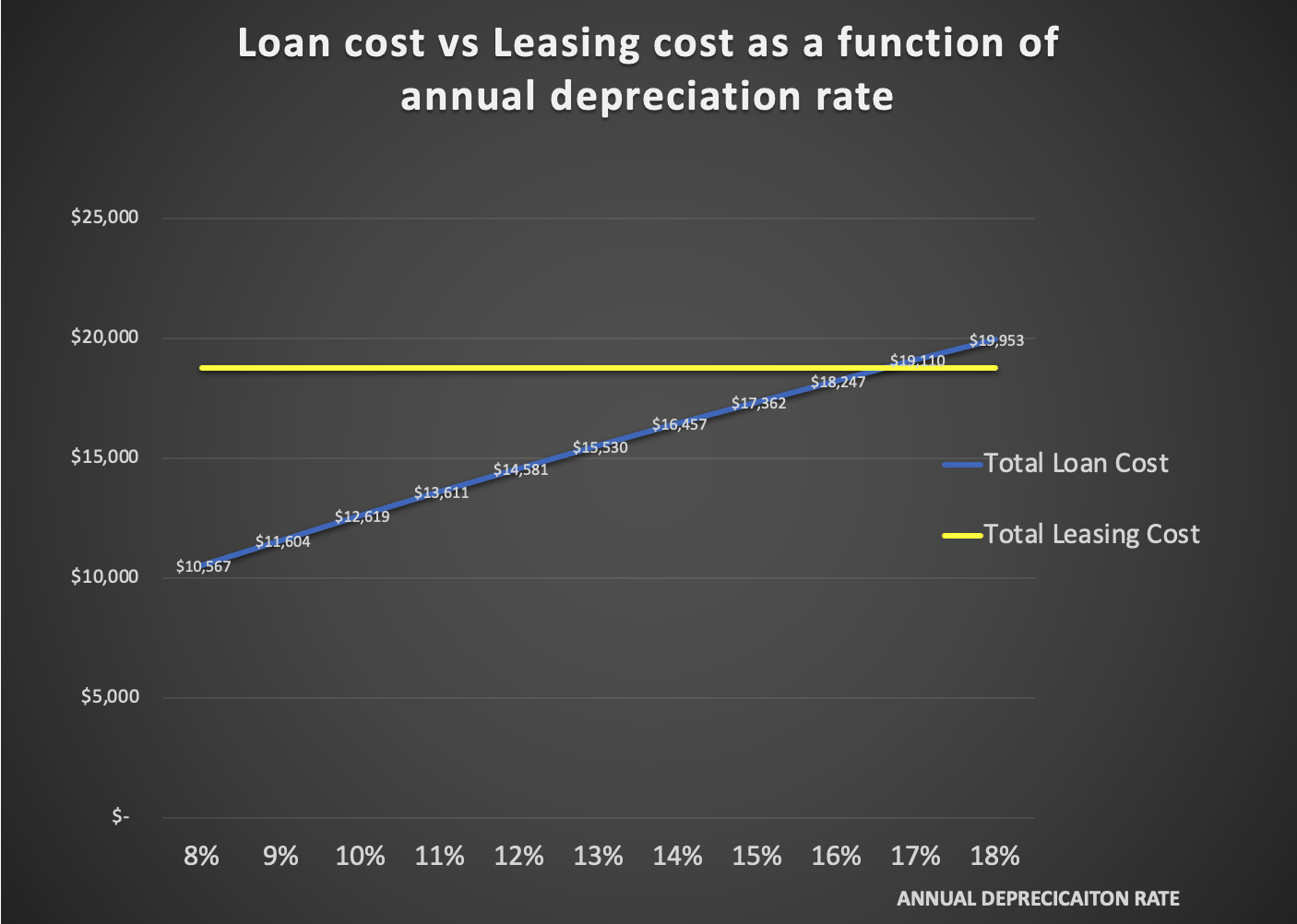

In order to see the effect of depreciation rate, we can vary that number in the spreadsheet and plot the resulting total loan cost (against the leasing cost, which, as I just mentioned, is pre-determined and will not vary):

As we can see, as the depreciation rate goes up, the cost difference between loan vs leasing becomes smaller. Once the depreciation rate is over 17%, then leasing becomes a cheaper option.

Now you may ask: can the annual depreciation rate for a Tesla car be as high as 17%? That means the car will lost 43% of its value in 3 years!

Well, judging from the current situation of strong demand, it is not likely to happen. But, it is still possible. In three years, a lot of things can happen. There will be a lot more EV choices other than Tesla. Technology may have breakthrough so that the current generation of EVs will be obsolete.

In my next post, I will explore deeper into such uncertainties, and how they might change your view on leasing vs buying.

The Excel spreadsheet of this post can be downloaded here.

Here is a video of me explaining:

Leave a Reply

You must be logged in to post a comment.