By now, we have all heard the story of Zillow losing more than $550 million doing house-flipping. Its CEO blamed it on its forecasting model that produced house-buying prices there were too high, saying that “We’ve determined the unpredictability in forecasting home prices far exceeds what we anticipated and continuing to scale Zillow Offers would result in too much earnings and balance-sheet volatility.”

I think that statement missed the mark on the real reasons behind its failure.

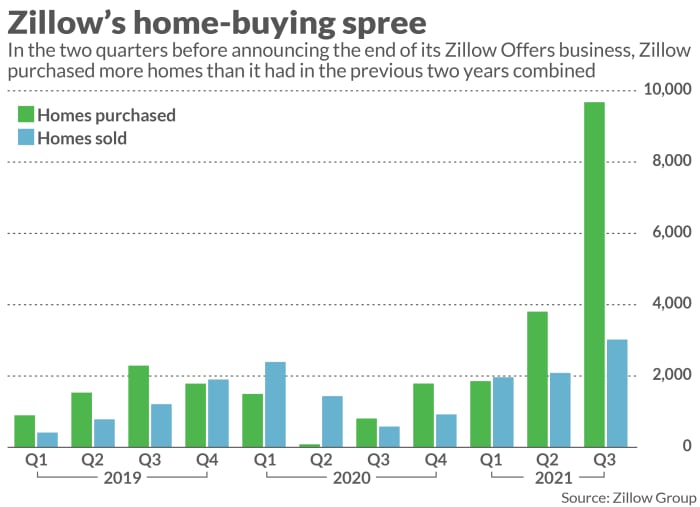

The first is managerial overconfidence and over-aggressiveness. During the past two quarters, Zillow itself disclosed that it bought more homes than the previous two years combined.

What on earth was the management thinking? One might say that its software, with its “sophisticated” AI algorithm, told Zillow to do so. But I do not think so. Rapid expansion is a managerial decision, aided by computer models perhaps, but still is a human decision.

In Q3, Zillow bought close to 10,000 homes. Assume its average purchase price is $500K, then that is $5 Billion committed! Even assuming Zillow uses very high leverage, and pays 10% cash, that is still $500 million spent in a quarter. For a company whose quarter revenue is just over $1 Billion, that is just reckless.

Management must be thinking that it will turn around and sell those houses in less than a month, or maybe at most two. But it ignored several important sources of uncertainty. The first is what if they had bought them at too high a price? Then it will take longer time to sell.

Secondly, it was clear that the demand is already cooling down – still growing, but at a much slower pace than 2020. But it seemed that Zillow was still betting the market craze of 2020 will continue.

Thirdly, in the beginning of 2021, it already became abundantly clear that the labor market was constrained, which means that it will be harder to find qualified contractors to do the remodeling and repairs on houses. It also means that those purchased home will sit on Zillow’s books longer.

Of course, I do not have the detailed data to back up my claims. Real estate markets are highly local, and it might be Zillow was making some bets in a few areas with high potential. Nevertheless, the big picture was still that Zillow took excessive risks.

In contrast, take a look at what Redfin did during the same period. They were doing the same thing, but actually made a profit. According to Glenn Kelman its CEO during the most recently earning call:

“But no matter what had happened the year before, RedfinNow could have grown to almost any size if we hadn’t been disciplined in how much we pay for homes. In March 2021, we began lowering RedfinNow offers, in anticipation of a summer deceleration in home-price increases.”

Noticed the difference here? Redfin was disciplined (this word was repeated 4 times in the Redfin earning call, by the way, whereas there was ZERO mentioning in the Zillow call) in its expansion, whereas Zillow was eager for market share. As a result, they overpaid and now are stuck with hundreds of millions of dollars worth of properties that are under water.

Redfin also very smartly realized a crucial bottleneck in the home-flipping business:

“…[R}enovating homes takes time and every day that we are swinging a hammer is a day that the market could fall out. And so being able to renovate homes quickly and knowing when you have bitten off more than you can chew and that you should never bought this money pit, because you are going to spend six months fixing it up before you get it on the market is a huge part of our discipline. We try to titrate our home buying appetite with our ability to renovate. Sometimes we see a great deal and then we check with the team that has to renovate it and we realize that we just have to postpone it, because they do not have the capacity to put in the work, and we don’t think we can sell it for a good price as this and that’s when we tell the customer you should stick with us instead and we’ll find another way to get it fixed up.”

Indeed it is a common mistake for people to ignore the effects of supply lead times, not to mention the effects of the variability in supply lead times. Redfin understood them and anticipated them whereas Zillow did not.

Managing a growth company is hard. But we can learn quite a few things from Zillow’s mistakes. Build enough margin of error in expansion strategies. Identify supply bottlenecks and lead times. Anticipate variabilities and incorporate them in forming strategies.