Yesterday, as I was reading a book about Blackstone, the famed asset management company, something caught my attention. It was about how one of its executives describing evaluating risks in a potential deal:

”

You say there’s a chance there’s a major terrorism event blowing up an airline, but that happens once in twenty years, so that doesn’t affect the base case because it’s one in twenty. Then there’s a chance that oil goes from $30 to a $140 a barrel in a year. It’s never happened before – the most oil has ever gone up is twenty bucks in a year. How could it go up a hundred? But there’s a probability to that […] All these unlikely things are one in ten, one in twenty, one in fifty, whatever they are, so you don’t put them in your base case because they’re very unlikely. […] The chance of any one of them happening is tiny, but the chance that none of them will happen is also tiny. You multiply it out and you find that there’s [say] a 55 percent chance that one of them will happen, and it kill you.

”

Quote from: page 189, King of Capital: The Remarkable Rise, Fall, and Rise Again of Steve Schwarzman and Blackstone

To me the above illustrate a super important lesson in evaluating risks: Each individual risk may be small, but because of joint probability being a multiplication, the chance of none of them happening is also small. So the chance of something goes wrong is actually high.

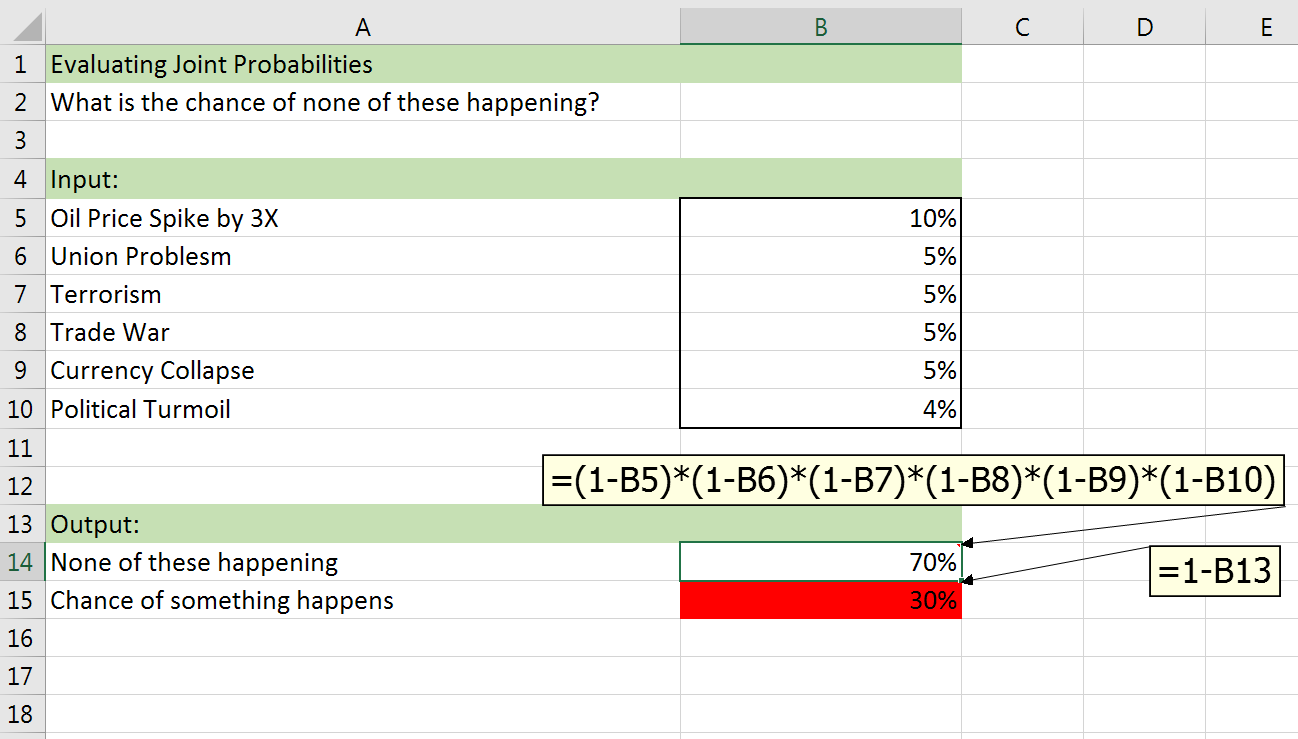

The following simple spreadsheet illustrates this:

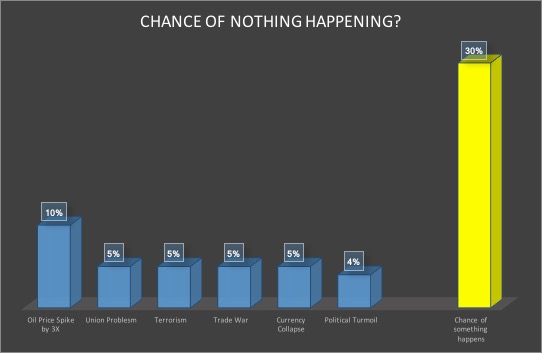

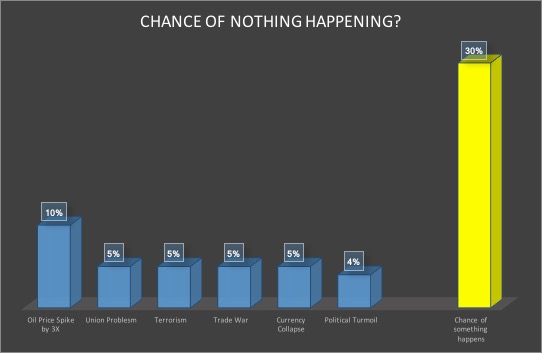

As you can see from above, there are six potential sources of risk, each being small, but putting them together, the probability of something happening is 30%, close to 1/3. Putting the numbers into graph, one can see this even more clearly:

In today’s volatile business environment, we face a myriad of uncertainty factors. That is why we see so many businesses and deals fail because they did not fully understand or anticipate the impact of joint probabilities of small-chance events.